Community Development

Maintaining and building strong relationships

We pride ourselves on cultivating and maintaining strong relationships with all our members – industrial, commercial and residential. PowerSouth offers not only flexible industrial rates and an inventory of priority industrial sites, but a number of funding programs and technical assistance to support your project decisions.

Our expert team will help you with your commercial and industrial account management – today and over the long-term.

View our offerings below.

Caleb Goodwyn

Community Development & Finance Representative

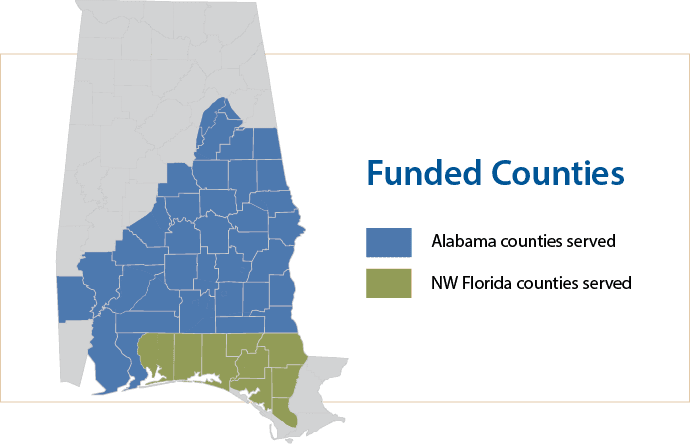

PowerSouth’s service territory, spanning nearly 50 counties across two states, is home to some of the southeast’s fastest growing communities. We aim to support and encourage this growth by working with our customers, connecting them to vital resources, and – where possible – providing for their needs.

Take advantage of the funding programs that exist in our service area.

Funding Programs

Provides zero-interest loans to Rural Utilities Service borrowers to promote rural economic development and job creation projects. Funds are passed on to third party borrowers as zero interest loans for projects that create jobs in rural areas, or that provide infrastructure or community facilities in rural areas that will lead to economic stability.

https://www.rd.usda.gov/programs-services/rural-economic-development-loan-grant-program

Under PowerSouth’s Business Development Loan Program, zero-interest loans for up to fifty percent (50%) of the value of a qualified project (not to exceed $600,000) are available to construct speculative buildings, provide infrastructure for multi-tenant industrial or business parks, or refurbish existing commercial & industrial facilities. Program funds cannot be used for working capital, production equipment, inventory or personal property.

PowerSouth’s members must provide twenty-five percent (25%) of the project’s financing (not to exceed $300,000), and the local community is responsible for the remaining funds needed for project completion. The loan term is the earlier of forty-eight (48) months or the date the property is sold. Should the facility be leased or occupied prior to the expiration of the 48 month term, interest must be paid on the loan for the remainder of the term.

PowerSouth, in conjunction with the Alabama Department of Economic and Community Affairs (ADECA), provides zero-interest energy efficiency loans to local governments and Boards of Education in communities with populations of less than 20,000 and counties of less than 50,000. Loan terms under this program may extend up to ten (10) years. ADECA loans are capped at $350,000 for local and county governments. The maximum ADECA loan allowed per school campus is also $350,000, with a maximum of $500,000 per school system. A letter of credit is required as collateral for all ADECA loans.

Just as PowerSouth Energy Cooperative provides a Revolving Loan Fund, many of PowerSouth’s member systems maintain their own Revolving Loan Funds.

Revolving Loan Fund General Guidelines

- Contact a local cooperative for interest rates, conditions, and terms.

- The maximum loan rate is the prime rate as published in the Wall Street Journal.

- The loan term is not to exceed ten (10) years.

- Building – 10 years

- Real estate – 10 years

- Equipment – 5 to 7 years (or anticipated life of the equipment)

- Working capital – 1 to 3 years Loan servicing fees are no more than 1% per year of the annual outstanding principal.

- Supplemental financing of 66% is required and must include at least 10% equity.

Availability, terms, and conditions may vary by cooperative.